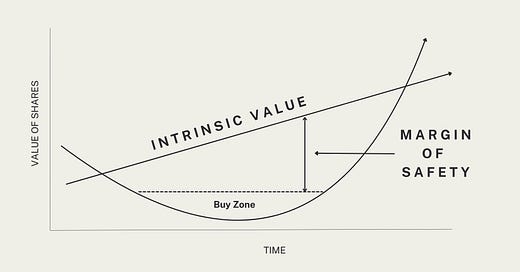

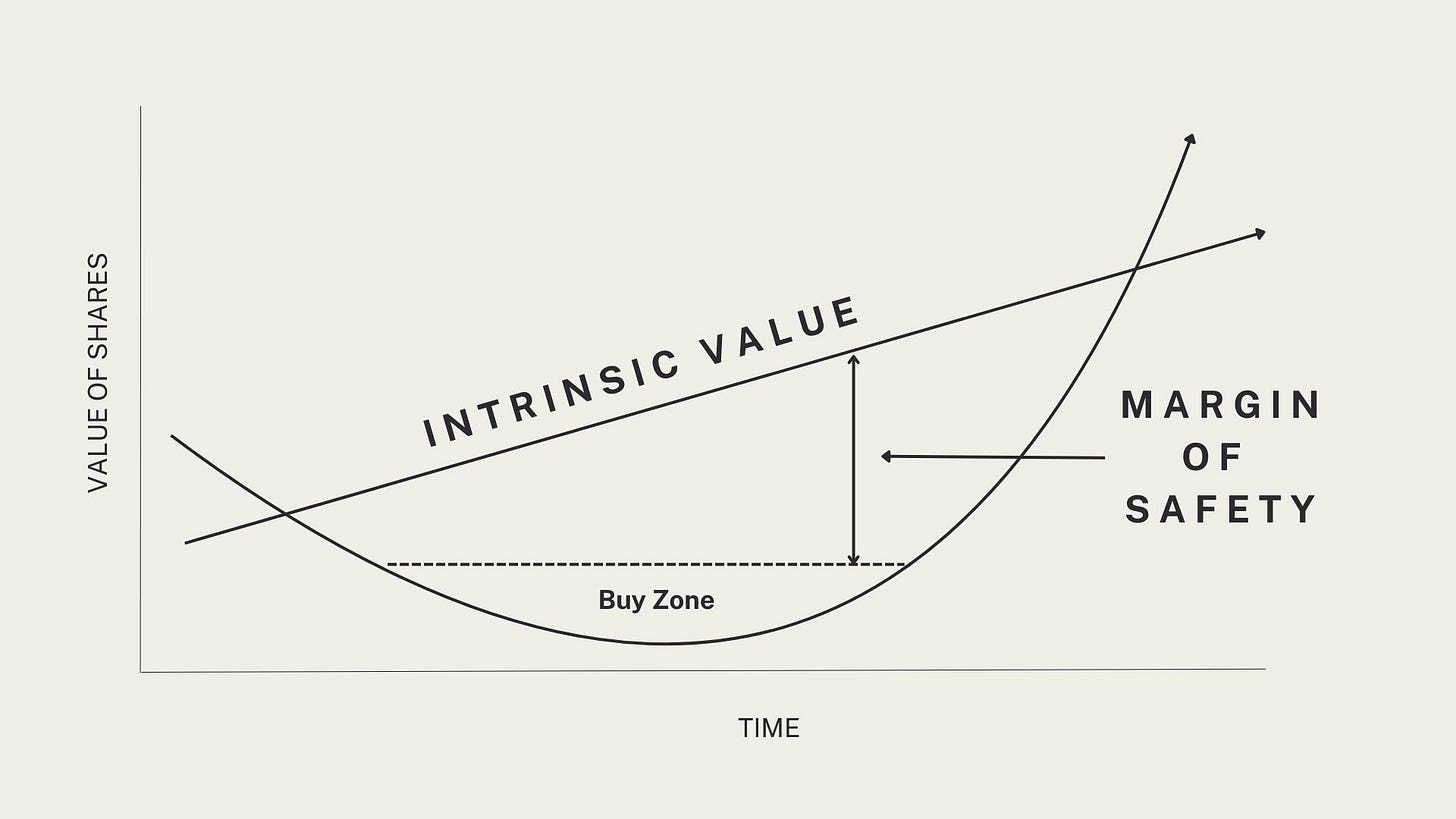

The margin of safety is a key concept in value investing, popularised by Benjamin Graham and successfully applied by investors like Warren Buffett. It refers to the difference between a company’s intrinsic value and its market price, providing a cushion against calculation errors and market volatility.

How to Calculate the Margin of Safety

The margin of safety is expressed as a percentage and is calculated using the following formula:

Margin of Safety = (Intrinsic Value - Market Price) / Intrinsic ValueFor instance, if a company’s intrinsic value is estimated at $100 per share and its current market price is $70 per share, the margin of safety would be:

((100-70) / 100) x 100 = 30%This indicates that the investor is buying the stock at a 30% discount to its intrinsic value, offering a buffer and reducing the risk of loss in case their valuation was too optimistic.

Key Factors for Investing with a Margin of Safety in High-Quality Companies

Buying stocks with a high margin of safety is not enough. To invest long-term in high-quality companies, it’s important to consider other factors:

Durable competitive advantages (moat): Companies with high barriers to entry, strong brands, significant share, or hard-to-replicate technology that protect them form competitors.

Consistent and sustainable growth: A stable track record of steady growth in revenue, earnings, and cash flow over time.

Financial health: Low levels of debt and strong balance sheets, indicating the company’s ability to withstand economic downturns.

Competent and shareholder-friendly management: Leadership that makes prudent capital allocation decisions and aligns with shareholder interests.

Robust free cash flow generation: The ability to generate cash beyond operational needs, enabling reinvestment and distribution to shareholders.

Practical Example: Apple Inc. (AAPL)

At the time of writing this post., Apple Inc. (AAPL) is trading at $240.15 per share. Assuming an investor estimates Apple’s intrinsic value at $300 per share based on factors such as brand strength, innovation pipeline, and financial performance, the margin of safety would be:

((300 - 240.15) / 300) x 100 = 19.95%This calculation suggests that purchasing Apple shares at the current market price offers approximately a 20% margin of safety relative to the estimated intrinsic value.

If the investor believes Apple will continue innovating and generating strong revenue in the long run, he might consider that buying with a 22% margin provides enough protection and an attractive investment opportunity.

However it’s important to note that intrinsic value assessments are subjective and can vary among investors. Therefore, conducting thorough due diligence and considering multiple valuation models (the intrinsic value should be estimated as a range rather than a single value) is essential before making investment decisions.

Conclusion

The margin of safety is an essential tool for reducing risk when investing in the stock market, but it should be used alongside a deep analysis of the company’s quality. A good investor doesn’t just look for a low price but seeks to buy exceptional companies at a discount, with sustainable advantages and long-term growth potential.